Control of cash transactions: TOP 7 types of fraud and errors at the cash register

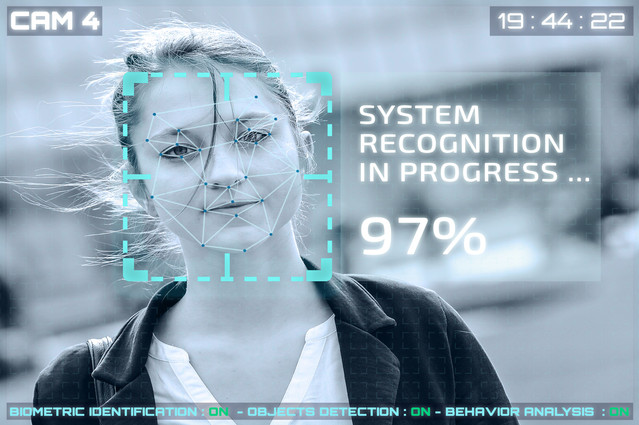

Video analytics: control of cash transactions

“They don’t steal from me,” any businessman will say. But at the same time, staff turnover is from 30 to 80% per year, and losses at the checkout are colossal — this is the usual picture in the retail and restaurant business. It is extremely difficult to gain the trust of cashiers with a high labour outflow.

Experts say one thing: control of cash transactions is the only effective way to protect a business from theft. This is what our article is about.

Why does the staff steal?

As the practice of the Russian retail market shows, a cashier-operator and cashier-seller are low-paid professions. However, given the small wages, such personnel deal with a large volume of money and goods on a daily basis. Man is weak, but the temptation is great. On average, losses in the checkout area can be up to 60% of all thefts made by the company’s personnel.

All detailed information about video surveillance in the store is in the article “Organization of video surveillance in a store: advice from professionals“.

Types of losses at the register

All types of company losses at the checkout can be divided into intentional fraud and unintentional errors. Violation of work regulations and operations requiring administrator intervention can also be distinguished into a separate group.

TOP-7 intentional methods of fraud at the checkout

TOP-7 intentional methods of fraud in the checkout area:

- Fictitious return of goods or part of the purchase (sometimes return of packaging instead of goods). The cashier takes the money.

- Sale of goods with a discount, although the buyer pays for the goods in full. The price difference is pocketed.

- Sale of goods without a receipt.

- Failure to issue small change to the buyer, and with a large flow of buyers, a large amount runs up.

- Deception with change (when, upon receipt of a large banknote, change, for example, from 5 thousand rubles, is issued as from 500 rubles).

- Work at the checkout not under proper name.

- Fraud with the quantity of goods. For example, adding items to a receipt.

TOP-7 mistakes in working with customers

TOP-7 mistakes in working with customers, when making payments at the checkout:

- Lack of verification of large bills.

- Random miscalculation.

- Random release of goods without payment.

- Re-grading of goods.

- Work at the cash register with an open cash drawer, as well as leaving the workplace with an open cash drawer.

- Not intentional double scanning of the item.

- Accidental sale at a discount.

Operations requiring administrator control

Without the participation of the administrator, the following violations at the checkout are possible:

- Reversing entries instead of cancellation.

- Unauthorized execution of a return receipt.

- Rebooting the cash register, and some devices may cancel the last receipt.

- Withdrawal of money from the cash desk.

- Presence of an unauthorized person in the cashier area.

Violation of corporate ethics

Compliance with regulations and corporate ethics is essential to optimize your business. Without video monitoring, it is difficult to fix the following violations:

- Violation of working standards (greeting, announcing marketing offers, assisting customers, or long wait).

- Violation of labor discipline.

- Improper appearance, phone calls and/or clutter at the checkout area.

- Presence of empty shelves. An article on this topic “Video surveillance in stores: control of empty shelves“.

How does the video control of cash transactions work?

Full-fledged video control of cash transactions consists of the following elements:

- installation of video surveillance (cash register);

- connection of intelligent video analytics;

- connection of a cloud platform for data storage;

- continuous video recording and tracking of suspicious activities. The algorithms use special filters, search by text and data of cash documents;

- receiving reports from the system. According to the set parameters, you can get statistics for each cashier. All abnormal readings are noted in the reports.

CONCLUSIONS: Entrepreneurs in the retail and restaurant business cannot but pay due attention to losses at the checkout. Control of cash transactions (video surveillance) is a fundamental condition for doing business.

Conclusion

As a rule, it is the fraud of the staff that hides behind suspicious transactions. Many types of scams are artfully sophisticated and difficult to control. Therefore, the only effective method of dealing with losses at the checkout is video surveillance with elements of artificial intelligence.